How To Set Up A Real Estate Llc

Starting a Real Estate LLC in Texas Is Easy

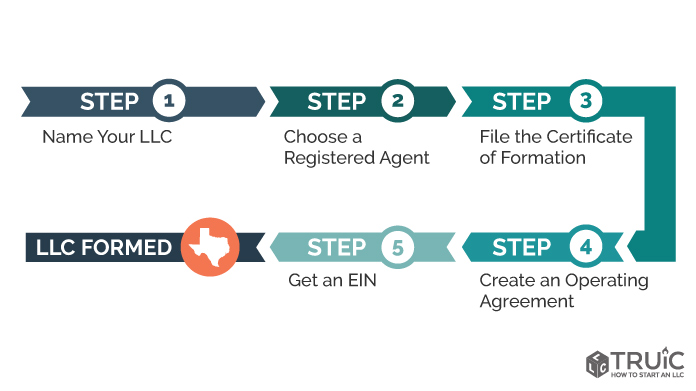

You can set up a real estate LLC in Texas by registering the Document of Formation with the TXSecretary of State. The cost to get a real estate LLC in Texas is $300.

Important: If you already ain holding and y'all have a mortgage, it's important to empathise your lender'due south requirements before transferring title to a new LLC.

Follow our How to Set Up a Real Estate LLC in Texas guide below to get started.

Step 1: Proper name Your Real Estate LLC

Choosing a company proper noun is the beginning stride in forming a real estate LLC. You'll need to requite your business organisation a unique name that meets Texas naming requirements.

You lot'll officially register your proper name when y'all file your Certificate of Formation.

- Cull a name that meets Texas naming requirements:

- Your proper noun must include the phrase "express liability company" or one of its abbreviations (LLC or Fifty.L.C.)

- Your proper name can't include words that advise your LLC is affiliated with a government agency (FBI, Treasury, State Department, etc.)

- Read the full list of Texas naming guidelines for more information

- Check if the proper noun is available in Texas. Brand certain the business organisation name you want isn't already taken by doing an LLC name search online. To learn more nearly searching for a Texas LLC proper noun, read our total guide.

- Use naming tools like our LLC Proper noun Generator and How to Name a Business guide if you need help brainstorming real estate business names.

- Check to see if your business organization name is available equally a web domain. You may want to buy the URL to prevent others from using it.

Nosotros recommend using foreclosure.com to discover great deals on the nigh up-to-date, local, and low-cost (distressed, tax liens, etc.) investment properties that would be otherwise difficult to find. With a database that updates twice a mean solar day, you can chop-chop secure your next real estate investment bargain and create new opportunities for your business concern.

Later on you go your business name, your side by side step is getting a unique logo. Go your unique logo using our Free Logo Generator.

Step 2: Cull an LLC Registered Amanuensis

When yous file your Certificate of Formation, y'all'll need to list a registered agent.

A registered agent'southward chore is to accept legal documents like service of process and tax notices for your LLC.

Your real estate LLC's registered agent can exist a person or a registered agent service. You lot can be your ain registered agent, but many business owners choose to employ a registered agent service.

Things to think about before choosing an agent for registered agent include:

- Availability: You'll demand to be bachelor during normal business hours (i.e., 9 a.1000.–5 p.m. Monday through Friday) at the accost yous provide

- Public Records: If you lot run your concern from home, y'all'll have to make your personal address public

- Privacy: Yous could exist served with a lawsuit in forepart of your family or coworkers

To learn more about Texas registered agents, read our total guide.

Many of the best LLC services offer a gratuitous year of registered agent service when you hire them to form an LLC.

Step 3: File Your LLC'south Certificate of Formation

To annals your Texas LLC, you'll need to file Grade 205 - Certificate of Formation with the Texas Secretary of State. This tin can exist washed online, by postal service, or in person.

Consider an South Corp tax condition for your real estate LLC. As an IRS tax nomenclature, an S corp can provide your real estate business with sure revenue enhancement benefits. Yous can detect out more if an Southward corporation is right for you with our LLC vs South Corp guide.

At present is a good time to make up one's mind whether your LLC will be member-managed vs. manager-managed.

Recommended: For aid with completing the form, visit our Texas Certificate of Formation guide.

OPTION 1: File Online With Texas SOSDirect

File Online

- OR -

OPTION 2: File Course 205 by Mail service or In Person

Download Form

Filing Cost: $300, payable to the Secretarial assistant of Land. (Nonrefundable)

Mailing Address:

Secretary of State

P.O. Box 13697

Austin, TX 78711

Filing Address:

James Earl Rudder Role Building

1019 Brazos

Austin, TX 78701

Step 4: Create a Existent Estate LLC Operating Agreement

An LLC operating agreement, known in Texas as acompany understanding, is a legal document that outlines the ownership and member duties of your real estate LLC.

Even single-member LLCs can benefit from having an operating agreement.

Your operating agreement should outline the post-obit:

- Each member'south responsibilities

- How new members will be admitted

- How existing members may transfer or cease their membership

- How profits and dividends will be distributed

- How and when capital letter calls will exist made

- Manager indemnification regarding mistakes made in proficient faith

- Tax and reporting timing

- Interest transfer and first correct of refusal to members if property is to exist sold

You tin can add together provisions to your existent estate LLC operating understanding, every bit long equally they don't conflict with Texas police.

Recommended: Download a template or create a custom free operating agreement using our tool.

Step 5: Get an EIN

An Employer Identification Number (EIN) is a number that's used past the United states Internal Revenue Service (IRS) to identify and taxation businesses. It's basically a Social Security number for a business organisation.

EINs are free when you lot apply directly with the IRS. Visit our What Is an EIN guide for instructions on getting your free EIN.

Steps Subsequently Forming a Existent Manor LLC

Later on forming your existent manor LLC, y'all'll need to exercise the post-obit:

- Open a Business organization Bank Account. A business bank business relationship legally separates personal finances from business finances. This separation is required to maintain your LLC's corporate veil (i.e., your limited liability protection).

- Transfer Existing Property(s) to Your New LLC. If you already own belongings that you'll be transferring to your new LLC, you'll demand to record a deed that reflects this change. This can be done with the aid of a title company or on your own. We recommend contacting a title visitor or your county clerk to go started.

- Update Your Lease. If you are transferring existing rental belongings to a new LLC, you'll need to update your residential lease agreement to reflect new ownership.

- File Your Texas LLC Annual Report. File with the Texas Comptroller of Public Accounts by May 15 each year. Reports do not need to be filed in the same yr that an LLC is formed. For more details, check out our Texas LLC Annual Written report guide.

Recommended: Consider setting up a business phone line by using phone.com to protect your phone number and other personal data.

Need Assist Forming an LLC?

Read our Best LLC Services review to larn more than virtually hiring an LLC germination service.

Related Manufactures

Texas Business organization Resources

Commodity Sources

Source: https://howtostartanllc.com/real-estate-llc/texas

0 Response to "How To Set Up A Real Estate Llc"

Post a Comment